Wealth

PENSION PLANNING

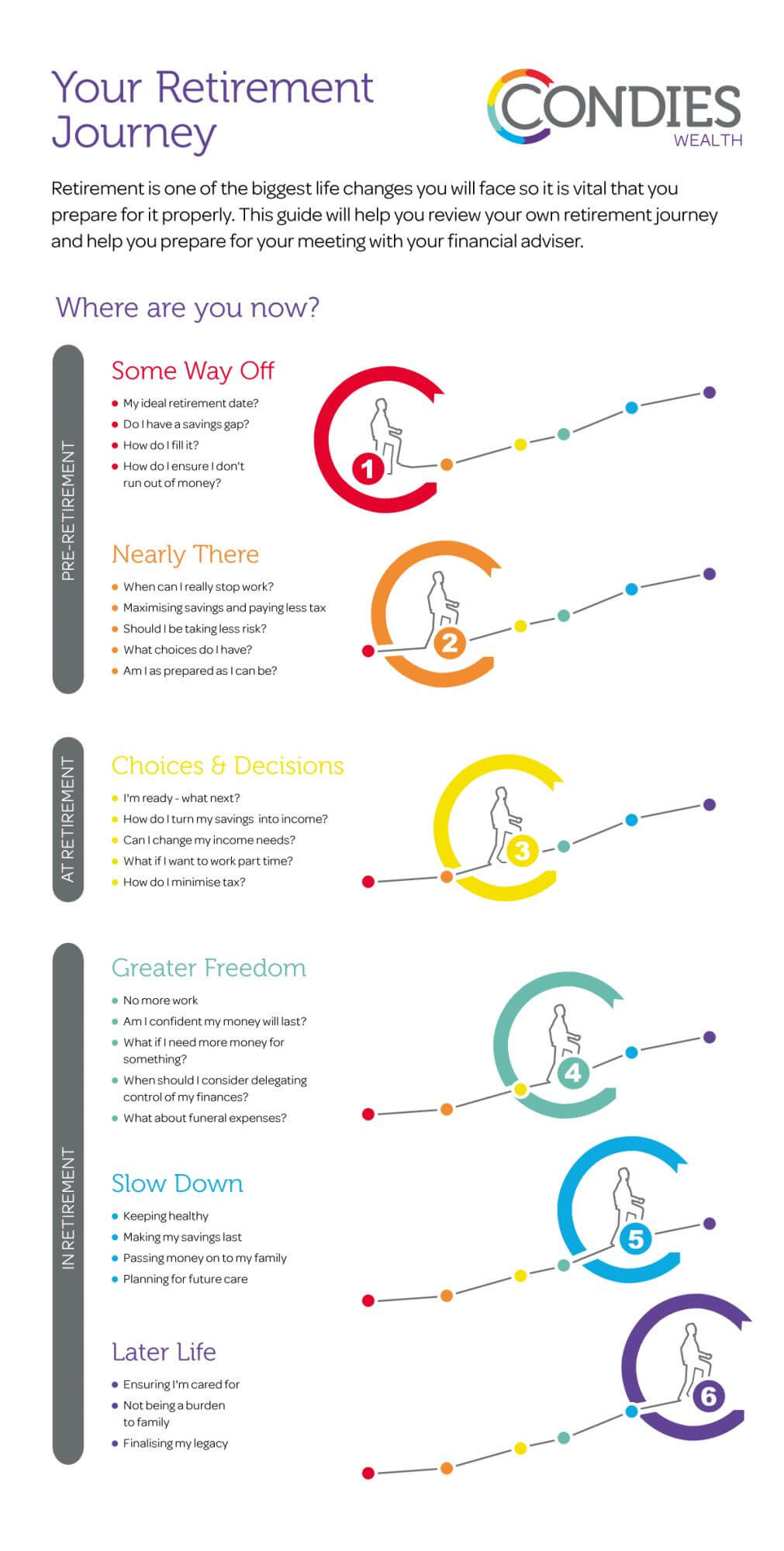

Looking at the graphic below, you can see there are various stages of retirement, which range from just starting your career and starting your first pension, to reaching retirement and then living in retirement.

We are here to help you through every stage, whether it’s the accumulation of assets (building up the pension pot) to the potential decumulation stage (the point when you start using your pension pot).

We will endeavour to simplify what can be a complex area, so that you have a plan of action, and then help review this plan as you move through the life stages. Some of the areas we can assist with are:

- Review existing pension arrangements (Stakeholder and Personal Pensions, SIPPs etc.).

- Potential consolidation of various contracts.

- Provide a better understanding of the rules and options available – including the new pension freedom rules introduced in 2015.

- Maximising the tax advantages, which can range from tax relief on the contributions, tax efficiency within the wrapper, tax efficient drawdown (including inheritance tax benefits).

- Review the underlying investments to try and ensure your goals are met, within an investment risk strategy you are willing to accept.

- Lifetime Allowance and Annual Allowance issues.

To speak to one of our specialist team, please email info@condieswealth.co.uk or call us

on 01383 721421.

Condies Wealth Strategies Limited, trading as Condies Wealth, is authorised and regulated by the Financial Conduct Authority (FCA) no.748895.

Registered in Scotland SC381967. Registered office 10 Abbey Park Place, Dunfermline, KY12 7NZ.

You should remember that the value of an investment and the income from it could go down as well as up. The return at the end of the investment period is not guaranteed and you may get back less than you have invested.

The guidance contained within the website is subject to the UK regulatory regime and is therefore primarily targeted at customers in the UK. Trusts, some forms of estate planning/inheritance tax solutions are not regulated by the Financial Conduct Authority. All statements concerning the tax treatment of products and their benefits are based upon our understanding of current tax law and HMRC practices both of which are subject to change in the future. Levels and bases of reliefs from taxation are also subject to change and are dependent on your individual circumstances'.

The Financial Ombudsman Service (FOS) is an agency for arbitrating on unresolved complaints between regulated firms and their clients.

FOS details can be found at https://www.financial-ombudsman.org.uk/